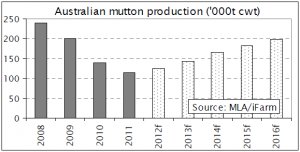

This was partly due to flock rebuilding and the fact that seasonal conditions have been favourable which is a contrast to recent years when farmers have been forced to offload due to drought. This year, the MLA predicts Australian mutton production to increase 9% to 124,000 tonnes. The Australian sheep flock is forecast to grow over the next five year years which will contribute to higher mutton production going forward.

Approximately 95% of Australia's total mutton is exported offshore. The Middle East continues to be a large market for Australian mutton. In 2012, it is forecast to take a 45% share of Australia's total mutton exports and this is expected to increase to 52% in the year 2013 according to the MLA. Sustained demand from the Middle East and China will encourage more exports along with increased mutton production.

Mutton prices in Australia and New Zealand have been falling off historical highs set in 2011. The price falls in Australia have been attributed to reduced demand for ewes from farmers, processors and live exports. Meat processors have been less inclined to chase ewes because of weaker overseas demand for mutton and the strong Australian dollar. Sheep prices for the remainder of the year are expected to remain favourable according to MLA, but are unlikely to reach the levels seen throughout 2011.

New Zealand mutton exports take up slack

While Australian mutton exports were at all time lows, New Zealand was able to pick up some of the slack. Strong prices for sheep encouraged high mutton slaughter through 2010-11, which was up nearly 20% up on the previous year and the highest level since 2006-07.

This led to NZ mutton exports nearly reaching 84,000 tonnes, up 23% on the season prior. Demand from Asia and the Middle East is expected to remain relatively strong going forward due to reduced global supplies and growth in theses economies, but as the MLA stated, prices are unlikely to reach the highs of 2011. Mutton exports this season to date are 22% off last seasons levels at 58,892 tonnes as of July.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |